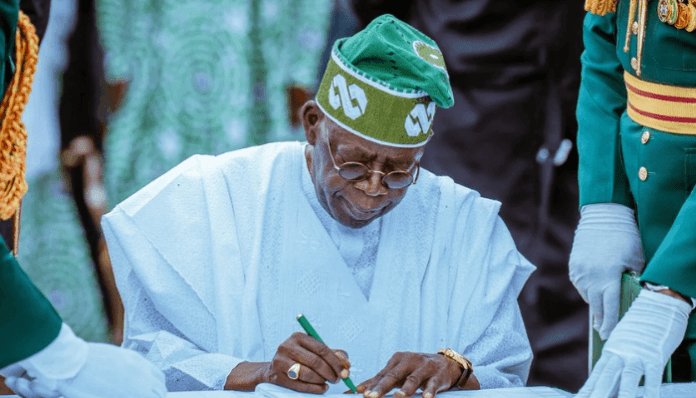

President Bola Tinubu has signed the N54.99tn 2025 Appropriation Bill budget into law. Tinubu signed the budget in the presence of principal officers of the National Assembly and other top government officials in a small ceremony in his office at the State House, Abuja, on Friday.

The bill was passed by the two Chambers of the National Assembly on Thursday, February 13, after Tinubu asked for an increase from the proposed N49.7tn.

The budget breakdown shows that N3.645 trillion was earmarked for Statutory Transfers, N14.317 trillion for Debt Servicing, while N13.64 trillion and N23.963 trillion were set aside for Recurrent Expenditure and Capital Expenditure (Development Fund) respectively.

The the document also shows that N14.317 trillion is set aside for debt servicing, reflecting Nigeria’s fiscal obligations while Recurrent Expenditure, covering salaries, overheads, and government operations, amounts to N13.64 trillion.

The National Assembly approved a ₦54.99 trillion ($36.6bn) budget for the fiscal year, surpassing President Bola Tinubu’s initial proposal of ₦54.2tn.

This increase reflects additional anticipated revenues from agencies such as the Federal Inland Revenue Service and the Nigeria Customs Service.

The budget aims to address key areas, including security, infrastructure, education, and health, with an allocation of $200m to mitigate the impact of recent U.S. health aid reductions.

READ ALSO: Lagos Assembly Lawmakers Storm High Court To Defend Obasa’s Removal As Speaker

The 2025 budget is based on ambitious economic assumptions, including a crude oil production target of 2.06 million barrels per day at a benchmark price of $75 per barrel.

Additionally, the Federal Government projects an exchange rate of ₦1,500 to the U.S. dollar and aims to reduce inflation from 34.8 per cent to 15 per cent within the year.

A significant component of the fiscal strategy involves tax reforms, which Tinubu says, are designed to enhance revenue generation and economic stability.

The proposed tax overhaul includes increasing the value-added tax to 12.5 per cent by 2026 while exempting essential goods such as food and medicine to alleviate the burden on households.

The reform also proposes reallocating VAT revenues to favour states that generate more, a move that has sparked debate regarding regional economic disparities.

The 2025 Appropriation Act represents a 99.96 per cent increase from the 2024 Budget of N27.5tn.